According to FitSmallBusiness.com, OnDeck is the best provider of short term small business loans.

FitSmallBusiness.com recently published an article comparing OnDeck, PayPal and Kabbage. The report crowned OnDeck as “the best short term loan provider to small businesses,” noting our financing is ideal for brick-and-mortar businesses that often are unable to access traditional bank financing.

OnDeck’s Competitive Advantage

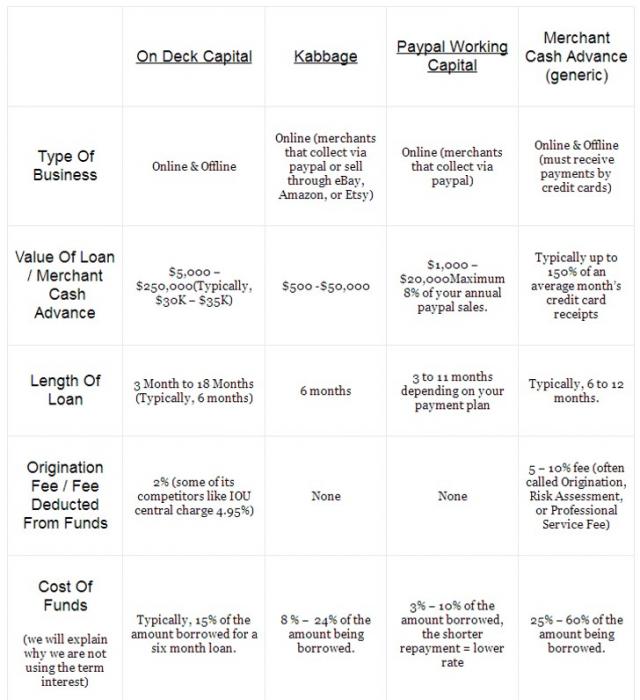

A side-by-side comparison illustrates OnDeck’s advantage in the following areas:

- Types of Business: OnDeck offers small business financing to both online and offline businesses. Kabbage is the best provider of short term loans to online businesses such as Amazon or Etsy merchants, and PayPal is most effective for businesses that operate within the PayPal ecosystem.

- Loan Size: OnDeck’s maximum loan value is $250,000 – five times more than the maximum loan offered by Kabbage ($50,000) and more than 14 times the maximum loan offered by PayPal ($20,000).

- Term Length: OnDeck’s term lengths are from 3 – 18 months with a 6 month average, while Kabbage has 6 month terms and PayPal from 3 – 11 month terms.

- Cost of Funds: All three options are less expensive than a merchant cash advance (to learn more about MCA’s, click here). OnDeck typically costs about 15% of the amount borrowed on a 6 month loan, while Kabbage and PayPal range from 8% – 24% and 3% – 10%, respectively, of the total amount borrowed.

Below is a full side-by-side break down from FitSmallBusiness.com:

To read the article in full, click here.

OnDeck is a Google Ventures-backed company with an A+ Rating with the Better Business Bureau. The company offers small business loans nationwide to over 725 different industries.