Articles

The Business Books That Small Bookstore Owners Want You To Read This Summer

If you’re looking for some good business-building books to read this summer, who better to ask than bookstore owners? Successful independent bookstore owners are simultaneously devoted readers and the proprietors of small businesses. Here, they share the titles that helped propel their stores to the top of the heap. So put down the murder mystery…

Boost Your Personal Credit Score: Take These Four Steps

For most small business owners, a personal credit score is still an important metric lenders may consider to measure your creditworthiness when evaluating your application for a small business loan. While different lenders weight the score differently, the benefits of building and maintaining a good personal credit score will likely never go away. With that…

4 Things You Can Learn from Online Lenders… Even if You Don’t Need a Loan

Online lenders are expanding access to capital for small business owners across the country. In fact, in a world dominated by traditional lenders, these new players are changing the way small business owners look for a business loan. How they’re doing it might even help your business. Here are four things you can learn from…

What Do Business Owners Think About OnDeck?

We love hearing from our customers. Here are just a few of the comments we’ve received over the last 30 days: “OnDeck proved to be an excellent source for short-term financing that enabled us to manage cash flow. The process was straightforward and remarkably fast. I would not hesitate to recommend OnDeck to other companies.”…

Video: Tips for Running Your Small Business Better (Part 2 of 4)

Online lending, and crowdfunding, and invoice financing, oh my! The new world of business financing may seem daunting, but it doesn’t have to be. Find out more about the options available to small businesses like yours in this 2nd video from our “Tips for Running Your Small Business Better” video series. In this video, we’re…

Meet Our Toronto $5K Prize Winner, Underdog’s Brewhouse

To celebrate our recent Canadian expansion, we held contests in Toronto and Vancouver to give small businesses the opportunity to win $5,000 (CAD) by answering one simple question, Why Do You Love Being a Small Business Owner? We received hundreds of submissions from very worthy small businesses of all kinds, and it was hard to…

Top Small Business Marketing Ideas for a Small Business Budget

A small marketing budget doesn’t mean you shouldn’t market at all, or that you need to settle for mediocre efforts and disappointing results. Some marketing techniques—think television ads or promotions at a major national event—come with a high price tag. Other, more affordable marketing techniques also work: they might reach a smaller audience, but they…

21 Terms You Need to Know Before You Apply for a Business Loan

It is very important that a business owner understand key commercial lending terms when he or she decides which loan or even which lender is the right fit. With that in mind, here are 21 terms that we’ve tried to make easy-to-understand and that every borrower should be familiar with before they sit down with…

Got Student Loans? You Can Still Own a Small Business

Student debt can create a daunting financial maze for would-be small business owners. Recent research shows that regions where the population carries student debt boast significantly fewer small businesses. Does that mean that owning a small business is not an option for those with student loans to repay? Absolutely not. With careful planning, you can…

5 Questions with Olive My Pickle’s Charlotte Tzabari

We’re thrilled to start sharing a new series called “5 Questions With…,” which takes a behind-the-scenes look into the daily lives of our small business customers. Name: Charlotte and Shai Tzabari Company: Olive My Pickle Location: Jacksonville, Fl. Products/Services: Lacto-fermented pickles, hummus, and olives Years in Business: 5 Years Facebook: olivemypickles Twitter: @olivemypickle Instagram: olivemypickle…

Content Marketing Essentials for Small Business Owners

Content marketing isn’t a new idea; businesses of all sizes have long used the power of education and entertainment to increase brand loyalty and create familiarity among buyers. What’s new is consumers’ constant use of online media and the infiltration of digital apps and devices into all areas of life. Content marketing, in other words,…

3 Types of Financing that Make Sense for Funding Inventory

Keeping the shelves stocked with what customers want to buy is sometimes a challenge for a small business owner trying to manage his or her other cash flow needs too. Fortunately there are inventory-financing options that can help you keep inventory on the shelves and your cash flow under control. What Type of Inventory Financing…

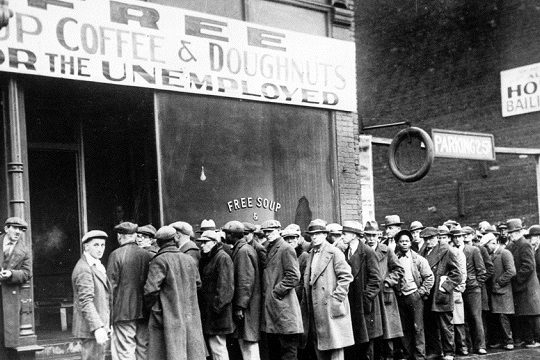

5 Success Stories that Prove Economic Crises Aren’t Always Bad for Business

With the ongoing turmoil in Greece, we’re reminded, yet again, that boom times don’t last forever. But In fact, economic recessions are not all bad news for businesses. Here’s why: Downtrodden economies can lead to great innovation. Existing companies must find new ways to survive and thrive, launching products that might not have fit in…

What is Operations? And Why Does My Business Need It?

So you want to extend your product line? Open a branch in an up-and-coming neighborhood? Resolve a purchasing inefficiency? Improve customer loyalty? If you answered yes to any of these, or have any specific goal in mind for your business, you should look to your company’s operations – the internal engine that powers your business.…

When Do Short-Term Business Loans Make Sense for Your Business?

There was a time not too many years ago when the local bank was the only place to get a small business loan. For a number of reasons, that isn’t always the case today. In fact, loan purpose, credit profile, and other factors play an important role in determining where a small business owner should…